Our Portfolio

Dual-Engine Impact: Where Alpha Meets Access

At Inclusive Ethic Capital, we’ve redefined what capital can be.

Not just a vehicle for return—but a vector of transformation.

Our model fuses the robust architecture of a high-efficiency, risk-optimized investment portfolio—anchored in ETFs, U.S. equities, hard assets, and macrohedging tools—with a strategic injection of microequity into undercapitalized, high-resilience micro-entrepreneurs in emerging markets.

This isn’t diversification.

This is dual-coding: a symbiotic system where each dollar not only seeks market performance but catalyzes human potential.

When markets stall, microbusinesses move. When volatility strikes, community resilience holds.

Returns and regeneration become co-multipliers in a hybrid financial engine designed for the next economy—the inclusive one.

We don’t separate profit from purpose—we algorithmically entangle them.

Our proprietary flow model synchronizes high-liquidity assets with grassroots economic energy, translating capital gains into life-changing credit, and repaid trust into reinvested momentum.

The result? A new financial grammar: where performance is measured not just in basis points, but in futures unlocked.

Metrics

In comparison to the benchmark (SP500), some values stand out:

Maximum drawdown is $578 (6.9%), compared to $2974 (52.9%) for the SP500.

Longest time in drawdown is 19.3 months, compared to 59.8 months for the SP500.

Total gain is higher by ~30%.

Net Profit / maxDD, is 31.1 compared to 2.9 for the SP500.

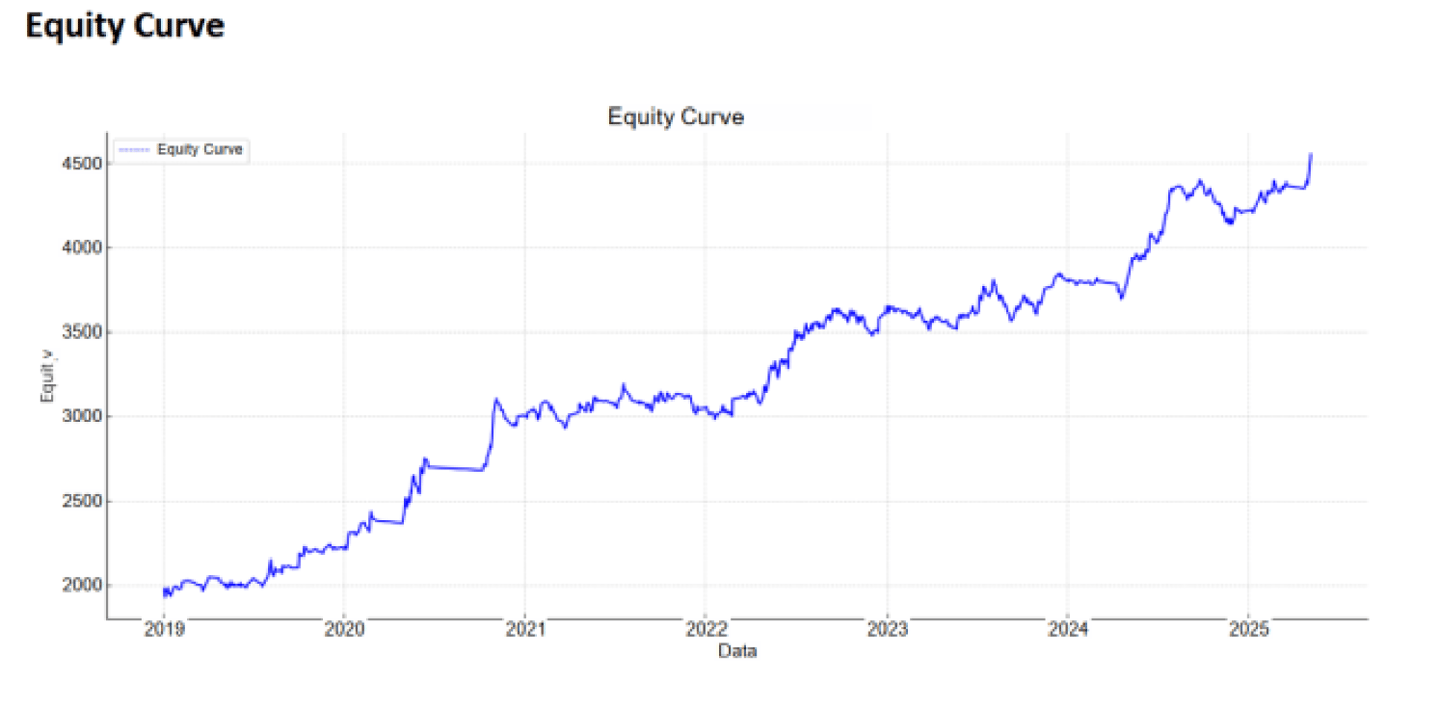

Portfolio 1 – 1 Jan 2019 to May 2025 – 2,000 USD (+125%)

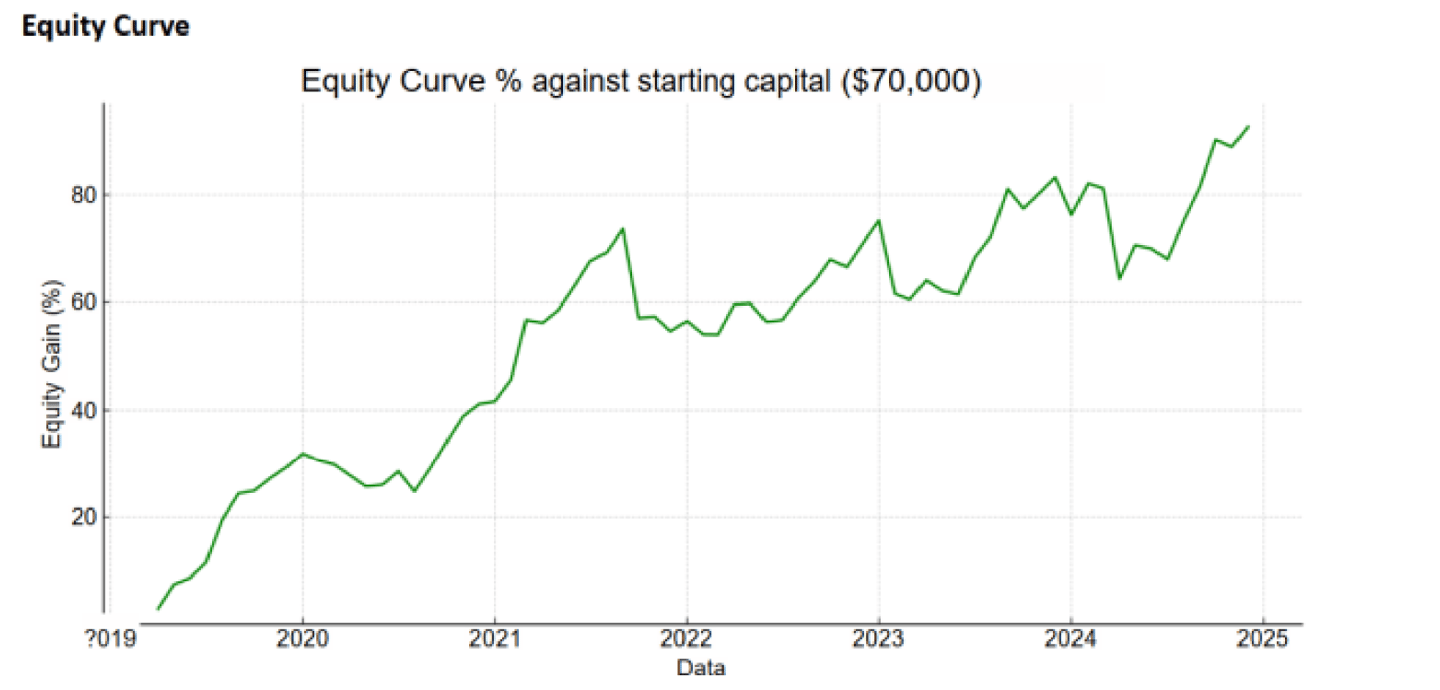

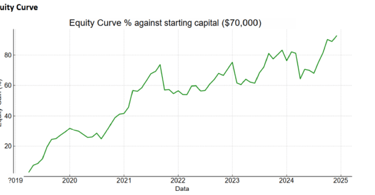

Portfolio 2 – 1 Apr 2019 to 1 Dec 2024 – 70,000 USD (+90%)

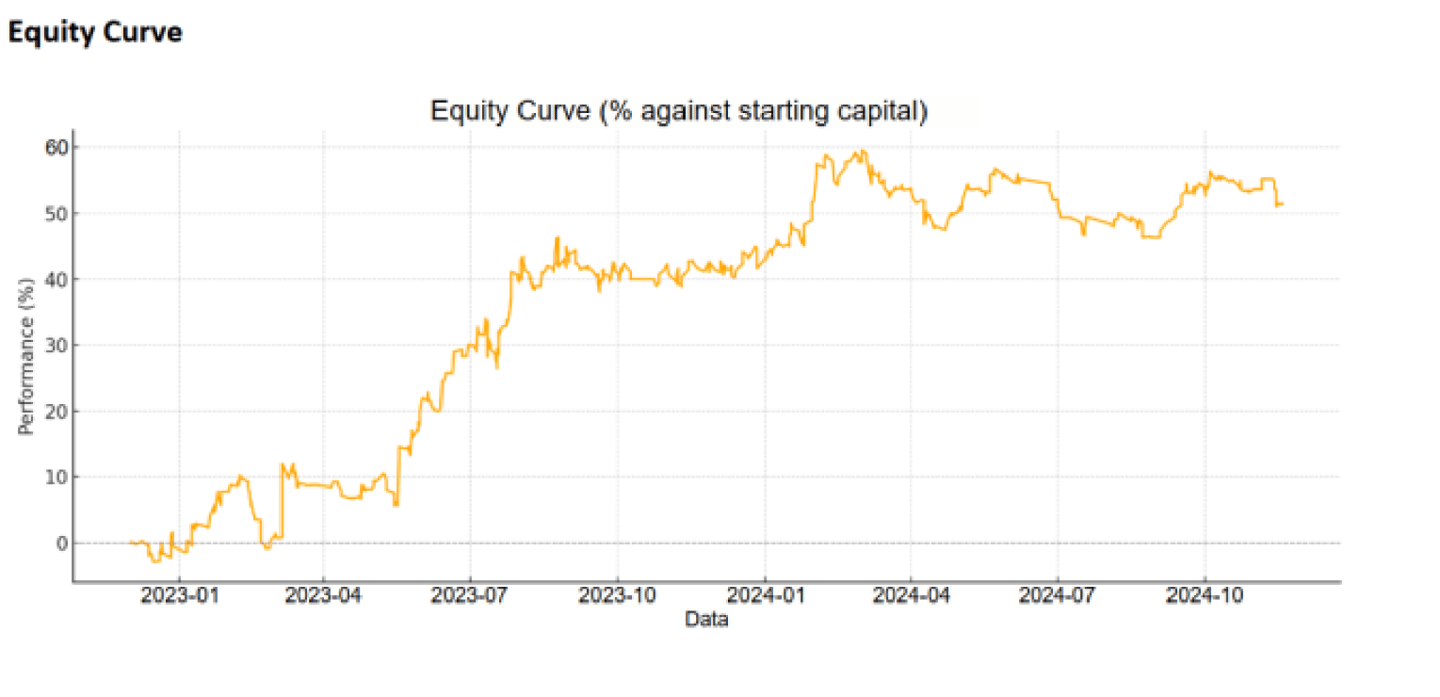

Portfolio 3 – 2 Dec 2022 to 18 Nov 2024 – 140,000 USD (+38%)

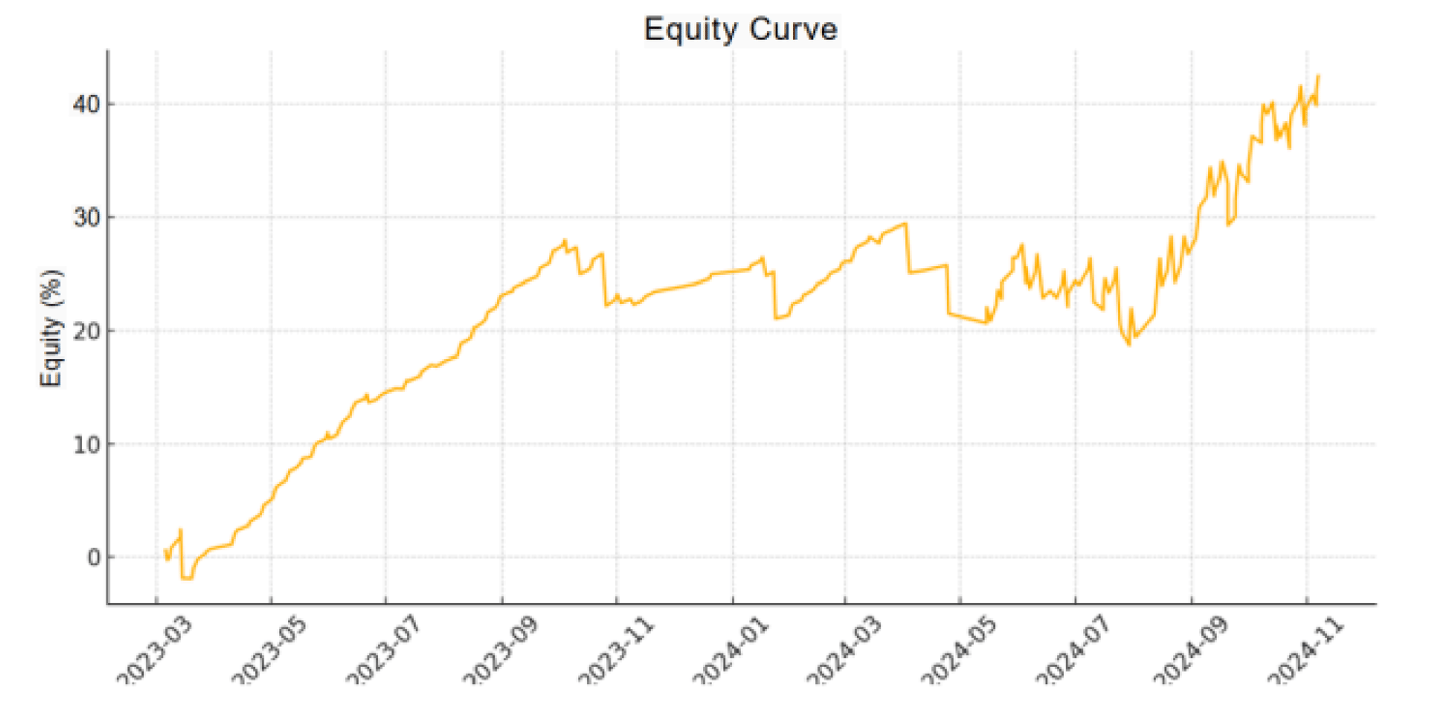

Portfolio 4 – 1 Mar 2023 to 1 Nov 2024 – 35,000 USD (+42%)